India’s first corporate credit card launched on RuPay network

India’s first corporate credit card launched on RuPay network

IndusInd Bank has introduced ‘eSvarna,’ India’s first corporate credit card on the RuPay network. The eSvarna RuPay credit card is uniquely designed to seamlessly link with any UPI-supporting app, enabling convenient payments.

According to IndusInd Bank’s press release on December 26, 2023, the card facilitates smooth transactions at merchant outlets and provides users with the flexibility to make UPI payments by linking the card with UPI-enabled apps.

IndusInd Bank claims that eSvarna is India’s pioneering corporate RuPay credit card to integrate with UPI, marking a significant milestone in their commitment to innovation and financial convenience. The bank expresses pride in being the first in the country to offer UPI functionality with a Corporate Credit Card.

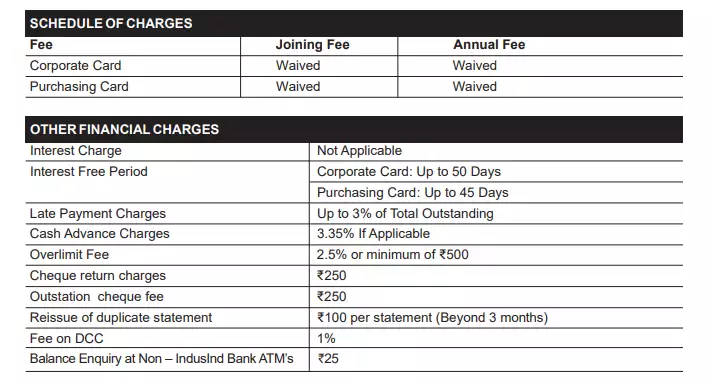

Currently, the eSvarna RuPay corporate credit card does not incur any joining or annual fees.

What features does the eSvarna RuPay credit card provide?

The eSvarna credit card is designed for frequent business travelers seeking airport lounge access. Notably, it is intended exclusively for business transactions, offering corporate travelers comprehensive travel insurance coverage and an exclusive rewards program. “Corporate travellers can receive the added benefit of comprehensive travel insurance coverage and an exclusive rewards program. This makes this credit card relevant for various business transactions,” said IndusInd Bank in the release.

According to Soumitra Sen, Head of Consumer Banking and Marketing at IndusInd Bank, Indian professionals and business travelers with a penchant for lifestyle-related value-added benefits can opt for this card. Addressing their discerning lifestyle needs, the card provides benefits across diverse categories such as travel, wellness, and lifestyle.

As per the IndusInd Bank website, the RuPay eSvarna credit card offers cardholders eight domestic and two international complimentary lounge visits annually. Additionally, a 1% fuel surcharge waiver is applicable at all fuel stations for transactions ranging from Rs 400 to Rs 4,000. The lost card liability insurance for the eSvarna credit card extends up to a limit of Rs 15 lakh.

If your card or card details are stolen and used fraudulently through counterfeit means, the bank provides extensive insurance coverage. In the event of card theft or loss, this insurance safeguards against unauthorized transactions upon reporting the loss to the bank. Additionally, the card includes travel insurance coverage, encompassing losses related to passport, ticket, baggage delay, missed connecting flights, and air accident death.

As of now, the Reserve Bank of India has only enabled UPI functionality on RuPay credit cards. Consequently, credit card holders with Visa and Mastercard cannot currently link their credit cards to a UPI app.

Contact us at the Consulting WP office nearest to you or submit a business inquiry online.